This website uses cookies

For the proper functioning and anonymous analysis of our website, we place necessary and functional cookies,

which have no consequences for your privacy.

We use more cookies, for example to make our website more relevant to you,

to make it possible to share content via social media and to show you relevant advertisements on third-party websites.

These cookies may collect data outside of our website. By clicking "Accept" By clicking you agree to the placing of these cookies.

You can find more information in our cookie policy.

Short Term Forecasting Data Scientist

- Eneco - Rotterdam

- Energy Trading

- 3-5 years

- €86.000 - €120.000

- 40 hours

- Reduce Imbalance Costs & Drive (Renewable) Profitability

- Direct impact on PnL

- Collaborate with passionate innovators driving the future of energy trading

Why choose Eneco?

The world around us is changing fast. Eneco is a frontrunner in the energy transition by integrating new sustainable energy sources and innovative ways of storing and managing energy. At the same time, customer needs are evolving rapidly, and so must we.

Within Eneco Trading, our international trading division, we aim to be a leading player in the European energy market, delivering flexibility and grid stability through sustainable energy. At the core of this mission lies our commitment to using advanced data science to operate and optimize our complex and diverse asset portfolio. Do you want to help us shape a sustainable future? Then we're looking for you!

You will work in a company that is large enough to get things done and diverse in people and technology, yet agile and innovative enough to move fast. At Eneco, anyone with a sharp mind and a positive attitude can make a difference.

What you’ll do

We’re looking for a full‑stack quant/data scientist who can turn ideas into production-ready forecasting products fast. In this role, you’ll own the entire lifecycle: from concept to live deployment. Your mission is to reduce latency, enhance forecast quality, and deliver trader-ready signals that directly impact P&L. You’ll work hands-on with Python, Spark/Databricks, MLflow, CI/CD, monitoring, and APIs, always balancing time-to-market with fit-for-purpose accuracy.

You’ll also help us uncover how weather patterns and diverse data sources influence our energy portfolio. This role goes beyond accuracy and speed; it’s driving commercial impact: improving P&L, reducing imbalance risk, and building forecasting products that give our traders a competitive edge. Working alongside analysts, meteorologists, traders, engineers and data scientists, you’ll create tools that sit at the heart of our trading strategy.

Is this about you?

- Experience: At least 3+ years in a forecasting or data science role, ideally in energy markets, trading, or other time-sensitive domains;

- Technical: Strong in Python and core data science libraries (pandas, NumPy, scikit-learn); proven ability to scale solutions with Spark/Databricks;

- Forecasting expertise: Hands-on experience with time-series modeling and short-term optimization; probabilistic methods and back testing discipline are a plus;

- Domain knowledge: Background in meteorology or weather-driven forecasting is highly valued, especially experience with NWP models and ensemble blending;

- Engineering mindset: Comfortable sparring with engineers on query optimization, job scheduling (Airflow or Databricks Workflows), and CI/CD best practices. You understand how to design solutions that are reliable, maintainable, and production ready;

- Entrepreneurial approach: You thrive in dynamic environments, take initiative, and look for gaps to maximize revenues;

- Collaboration & communication: Skilled at bridging technical and commercial teams; able to turn complex insights into actionable decisions.

You’ll be responsible for

- Own end-to-end forecasting products: from problem framing and data strategy to modeling, back testing, deployment, monitoring, and continuous improvement;

- Ship quickly: prioritize time-to-market, deliver “good-enough” baselines fast, and iterate toward P&L impact (balancing speed vs. accuracy);

- Productionize at scale: build forecasting products that can adapt to changing portfolios, with robust MLOps practices (e.g., model versioning, automated deployment, monitoring);

- Risk & impact focus: Proactively reduce imbalance costs and risk and collaborate with analysts to set up the right KPIs to measure value. Also proactively be aware of low hanging fruit to improve;

- Developing and improving short-term forecast products tailored to the needs of our trading desks;

- Acting as a sparring partner for operations, engineering and maintaining strong communication across departments;

- Contributing to a forward-looking strategy and exploring new forecasting methodologies and contributing to the long-term forecasting roadmap.

This is where you’ll work

Behind six screens you'll find Eneco's balanced, analytically strong decision-makers. The Energy Trading Desk is the heartbeat of the operation: a high-impact, high-focus environment where portfolio components come together and real-time decisions are made. It’s the portal to the outside world, where we negotiate with exchanges, energy suppliers, and banks.

You’ll be working side by side with analysts, traders and engineers to ensure Eneco delivers the right amount of energy, every single day.

Our collaborative and technically advanced environment ensure you have all the tools to experiment, iterate, and improve forecasting models that directly influence P&L outcomes and trading success.

What we have to offer

Gross annual salary between €86.000 and €120.000

FlexBudget

Personal and professional growth

Hybrid working: home, office or abroad

Want more information about our terms of employment?

Work that works for you and the climate

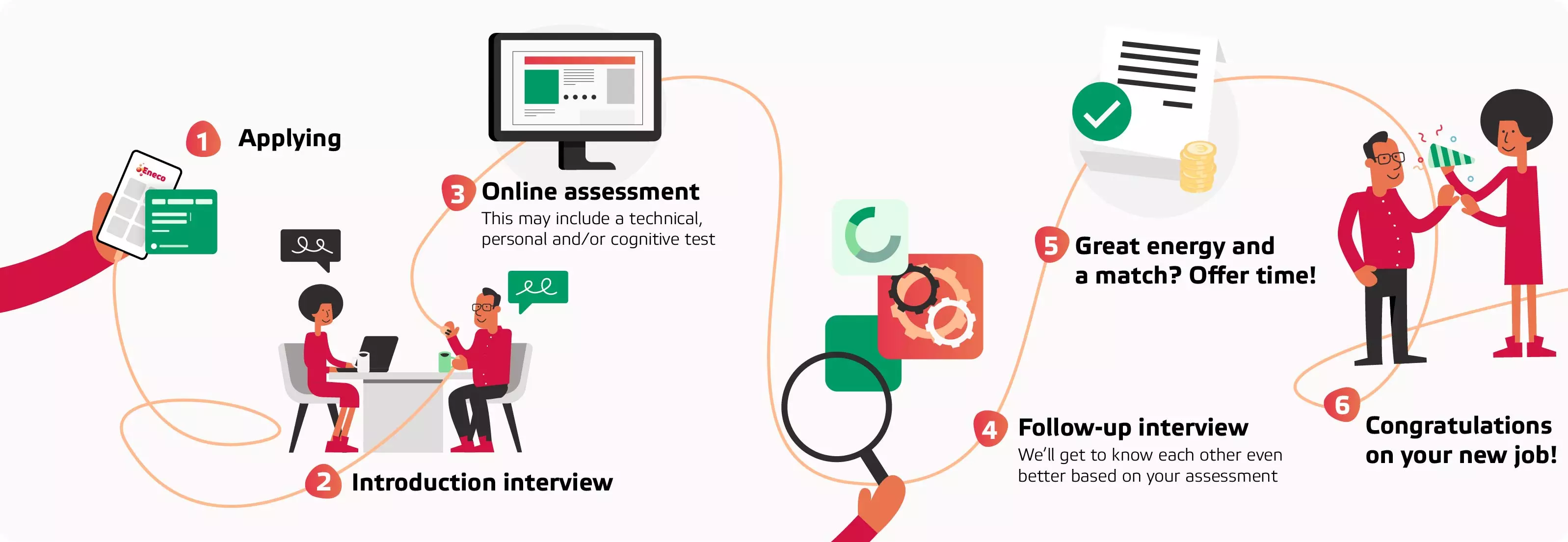

The phases of our application procedure:

Want to know more about this job function?

Questions about the application procedure

Raymond Bosch

Send an email