This website uses cookies

For the proper functioning and anonymous analysis of our website, we place necessary and functional cookies,

which have no consequences for your privacy.

We use more cookies, for example to make our website more relevant to you,

to make it possible to share content via social media and to show you relevant advertisements on third-party websites.

These cookies may collect data outside of our website. By clicking "Accept" By clicking you agree to the placing of these cookies.

You can find more information in our cookie policy.

Quantitative Developer/Analyst (Medior/Senior)

- Eneco - Rotterdam

- Energy Trading

- 3-5 years, > 5 years

- €90.000 - €145.000

- 40 hours

You are situated at the heart of Eneco, right between production, sales, and trading

You work on complex and analytical challenges in the dynamic energy market

You’ll help Eneco navigate volatility, risk, and opportunity in the evolving energy market

Why choose Eneco?

Eneco is at the forefront of the energy transition integrating renewable generation, flexible assets, and new ways of balancing supply and demand. As energy markets become more volatile and interconnected, the need for smart risk management and data-driven decision-making only grows.

Our newly established Systematic Trading Desk develops and runs proprietary quantitative strategies to diversify Eneco’s market exposure. The desk also acts as a catalyst for improving and automating trading workflows across the other desks. As a front-desk Quantitative Developer, you’ll make sure that we have the necessary data and that we build tools that let systematic strategies move from idea to live trading and continuously improve.

What you’ll do

As a front-desk Quantitative Developer, you will build and maintain the tooling, data foundations, and research/production workflows that allow strategies to be developed, tested, deployed, and monitored reliably. You’ll work closely with systematic traders and analysts, and collaborate with colleagues covering discretionary power, gas and carbon.

Is this about you?

We’re looking for someone with solid quantitative development skills combined with experience in quantitative trading analysis.

- 4–5+ years (for Medior) of relevant experience in quantitative development / trading tooling / front-office analytics support, building production-grade code (Python). Senior role candidates will have substantial additional experience and end-to-end ownership;

- Highly valued: experience working directly with traders and front-desk analysts to translate needs into clear requirements and deliver workable solutions in a fast-paced environment.

Trading Strategy & Market Understanding

- Solid understanding of financial markets—energy commodities preferred—and how a trading desk operates.

- Understands the core building blocks of a systematic trading strategy (signals/features, position sizing, constraints, execution logic, and monitoring).

- Comfortable with quantitative trading analysis: descriptive statistics, distributions, correlations, backtesting basics, and interpreting performance metrics (e.g., returns, drawdowns, Sharpe/Sortino, hit rate).

- Proven experience directly partnering with traders to translate business needs into clear technical requirements and workable solutions.

- Strong communication through visuals: produce clear, actionable dashboards and reports for traders.

Quant Development

- Strong Python skills with a focus on modular, performant, testable code.

- OO design, event-driven patterns, asynchronous programming; multithreading where relevant.

- Ability to build analytical and real-time dashboards using tools like Grafana, Power BI, or similar platforms.

- Experience with good software delivery practices: Git, unit/integration/regression testing, and CI/CD pipelines.

- Experience working with cloud-based platforms and scalable infrastructure (compute, storage, containers such as Docker/Kubernetes).

- Able to design/shape reliable real-time and historical market data pipelines, with strong attention to data quality, latency, and reproducibility (in collaboration with the Data Engineering Team).

- Familiarity with analytics platforms (e.g., Databricks) and orchestration tooling (e.g, Airflow or equivalents) is a plus.

- Nice to have: performance-oriented tooling (e.g., NumPy/pandas/Polars/Numba) and/or exposure to C++ or Rust.

- Nice to have: building event-driven components (e.g., Azure Functions or similar) for scheduled and reactive workflows.

You’ll be responsible for

- Improve our trading strategy backtesting and optimization frameworks to support scalable runs, better performance metrics, and robust result storage/comparisons;

- Refine trading strategies through backtesting, tuning free parameters, scenario analysis, and sensitivity checks;

- Build analytical and real-time dashboards for traders (strategy status, run controls, key metrics, performance reporting);

- Analyze new market data sources, define data requirements, clean/validate datasets, and make them available for research and production use;

- Perform validation steps to make strategies production-ready: testing, monitoring, controls, documentation, and handover;

- Liaise with Compliance and Risk when needed to ensure appropriate controls, auditability, and sign-off;

- Liaise with IT teams to ensure the right infrastructure and connectivity are set up (data pipelines, databases, interfaces/adapters);

- Liase with Trade Operations teams to ensure proper interaction with deal capture and business reporting systems;

- Translate front-desk needs into clear technical requirements, and perform business testing (UAT) to validate solutions before go-live.

This is where you’ll work

You’ll join Asset Backed Trading (ABT) — our front-office trading organization with multiple desks active across power, gas, carbon and related markets, from day-ahead to multi-year horizons, using both physical and financial instruments. Within ABT, you’ll be part of the Trading Analytics (Trade Analysis) Team, which provides the analytical backbone of the desks and is organized into several specialist streams. You will join Quantitative Analysis & Development, the stream focused on quantitative development for the Systematic Trading Desk (running a portfolio of proprietary, model-driven strategies). The environment is international, fast-paced, and highly collaborative, bringing together talent from diverse academic and professional backgrounds.

What we have to offer

Gross annual salary between €90.000 and €145.000

FlexBudget

Personal and professional growth

Hybrid working: home, office or abroad

Want more information about our terms of employment?

Work that works for you and the climate

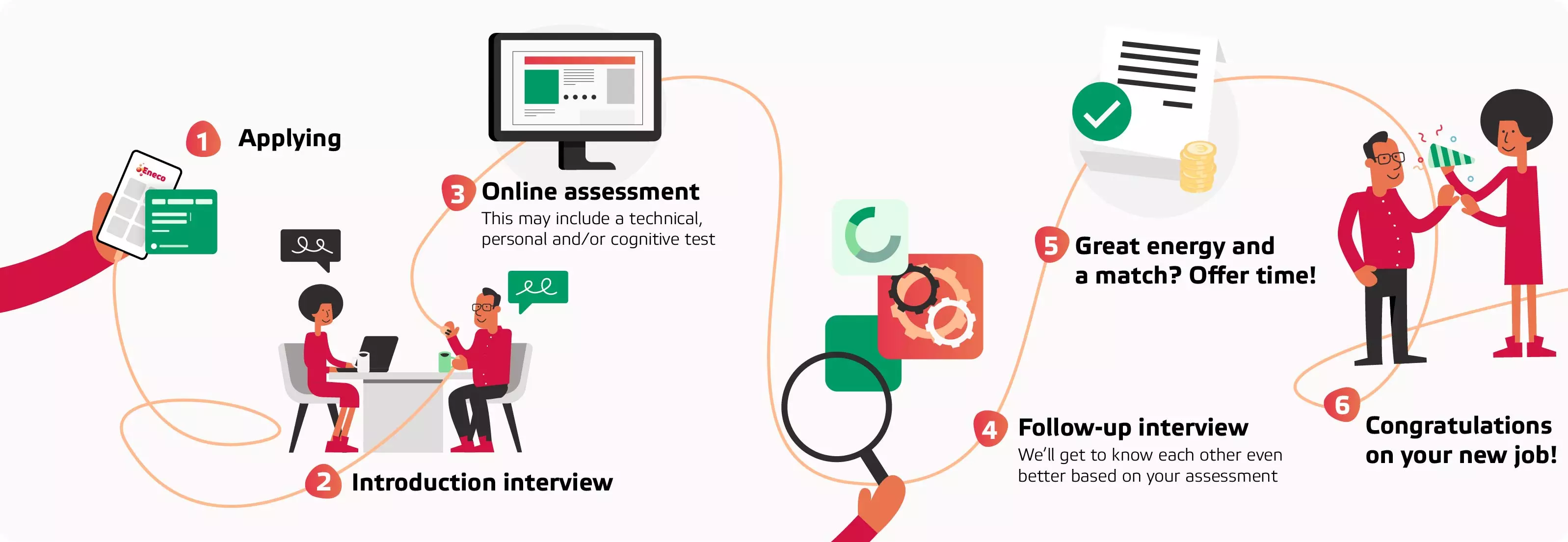

The phases of our application procedure:

Want to know more about this job function?

For more information about how to apply, you can contact our recruiter at [email protected] . If you think that you are a good fit, then don't wait and apply right now. You can do it quickly and easily through our recruitment system. Click the 'apply' button and send your CV and motivation letter.

Questions about the application procedure

Raymond Bosch

Send an email