This website uses cookies

For the proper functioning and anonymous analysis of our website, we place necessary and functional cookies,

which have no consequences for your privacy.

We use more cookies, for example to make our website more relevant to you,

to make it possible to share content via social media and to show you relevant advertisements on third-party websites.

These cookies may collect data outside of our website. By clicking "Accept" By clicking you agree to the placing of these cookies.

You can find more information in our cookie policy.

Quantitative Analyst

- Eneco - Rotterdam

- Energy Trading

- > 5 years, 3-5 years

- €86.000 - €128.000

- 36 - 40 hours

You are situated at the heart of Eneco, right between production, sales, and trading

You work on complex and analytical challenges in the dynamic energy market

You’ll help Eneco navigate volatility, risk, and opportunity in the evolving energy market

Why choose Eneco?

The energy transition is in full motion and Eneco is helping to lead it. Our ambition? That goes for our operations and the energy we deliver to millions of customers. From building wind and solar parks to innovating in energy trading. We're investing in real impact and scaling that impact across Europe.

To accelerate this journey, we're looking for sharp analytical minds. As a Quantitative Trading Analyst, you’ll play a key role in supporting our trading activities with advanced quantitative finance models and tools, enabling data-driven decisions in a fast-moving and highly strategic environment.

What you’ll do

You will contribute to the commercial success of Eneco’s trading desk by performing best-in-class quantitative modelling related to option valuation, hedging and related risk quantification. You will be maintaining and constantly improving our existing models, tools, frameworks and also building new ones. Your will work closely with other Quantitative Trading Analysts and with our traders.

Is this about you?

You bring:

• A degree (MSc or PhD) in a quantitative field (financial mathematics, financial engineering, econometrics, statistics, machine learning or other).

• At least 3+ years of relevant experience.

• Knowledge of quantitative finance is a must.

• Proven experience in analyzing data and building quantitative models.

• Excellent programming skills and knowledge about modern code deployment techniques. Python is the main language of development.

• Experience in the energy markets is welcome.

• Pro-activeness in exploring new trade ideas and improving existing models and processes.

• Your approach is analytical but also hands-on and pragmatic.

• The ability to stay focused in a fast-moving environment where priorities shift with the market.

You’ll be responsible for

• You will have direct impact on trading decisions and strategies and work closely with our traders. This can include both discretionary and systematic trading strategies.

• You will work on topics related to option valuation and hedging.

• You will be involved in other related quantitative modelling topics such as forward curves, Monte Carlo simulation engines, quantifying market risk of our trading portfolio, and others.

• You will use “classical” financial mathematics methods, but also explore machine learning techniques.

• Quantitative software development will be an important part of your work. We develop, review and test our quantitative tools. You will gain experience in all stages of software development and be a driver in using modern tools, such as Azure DevOps, DataBricks, AirFlow, Snowflake, and others.

• You will automate different models and drive the automation trading processes.

This is where you’ll work

You’ll join the Trading Analysis Team. This a front-desk analytical team which works alongside traders on our trading desk, which is responsible for trading carbon, gas, and power from day-ahead up to several years ahead, using futures, options and other derivatives. The team provides the analytical backbone of the desk.

What we have to offer

Gross annual salary between €86.000 and €128.000

FlexBudget

Personal and professional growth

Hybrid working: home, office or abroad

Want more information about our terms of employment?

Work that works for you and the climate

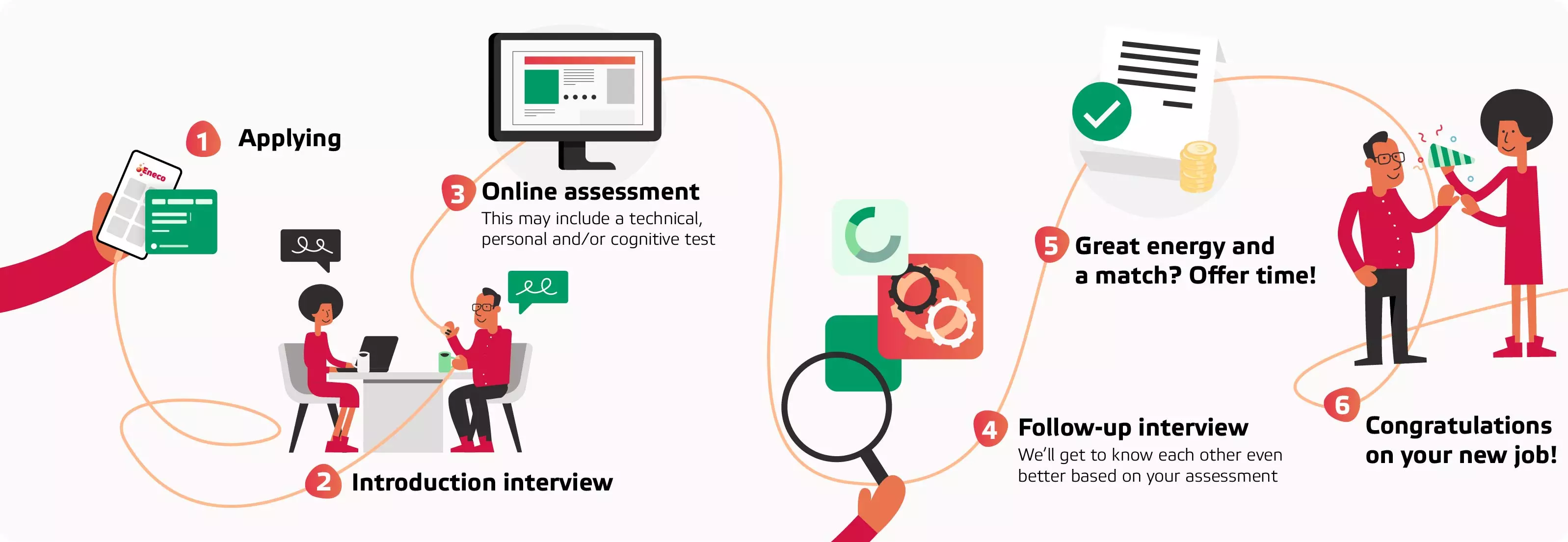

The phases of our application procedure:

Want to know more about this job function?

For more information about how to apply, you can contact our recruiter at [email protected] . If you think that you are a good fit, then don't wait and apply right now. You can do it quickly and easily through our recruitment system. Click the 'apply' button and send your CV and motivation letter.

Acquisitie naar aanleiding van deze advertentie wordt niet op prijs gesteld.

Questions about the application procedure

Raymond Bosch

Send an email