This website uses cookies

For the proper functioning and anonymous analysis of our website, we place necessary and functional cookies,

which have no consequences for your privacy.

We use more cookies, for example to make our website more relevant to you,

to make it possible to share content via social media and to show you relevant advertisements on third-party websites.

These cookies may collect data outside of our website. By clicking "Accept" By clicking you agree to the placing of these cookies.

You can find more information in our cookie policy.

Data Scientist Short Term Trading

- Eneco - Rotterdam

- Energy Trading

- 3-5 years, > 5 years

- €86.000 - €128.000

- 36 - 40 hours

Work on data driven solutions that maximize the value of Eneco’s steerable asset portfolio

You will build bidding algorithms and machine learning models that operate in fast-moving, real-time energy markets

Collaborating closely with teams across Trading, Forecasting, IT, and Operations.

Why choose Eneco?

The world around us is changing fast. Eneco is a frontrunner in the energy transition by integrating new sustainable energy sources and innovative ways of storing and managing energy. At the same time, customer needs are evolving rapidly, and so must we.

Within Eneco Trading, our international trading division, we aim to be a leading player in the European energy market, delivering flexibility and grid stability through sustainable energy. At the core of this mission lies our commitment to using advanced data science to operate and optimize our complex and diverse asset portfolio. Do you want to help us shape a sustainable future? Then we're looking for you!

You will work in a company that is large enough to get things done and diverse in people and technology, yet agile and innovative enough to move fast. At Eneco, anyone with a sharp mind and a positive attitude can make a difference.

What you’ll do

As a Data Scientist in the Flex Optimization team, you’ll work on data driven solutions that maximize the value of Eneco’s steerable asset portfolio by optimizing their flexibility across short-term power and ancillary markets.

Your work will impact Eneco’s trade result and contributes to a smarter, cleaner energy system. You will build optimization strategies, bidding algorithms and machine learning models that operate in fast-moving, real-time energy markets (such as real time trading applications for battery optimization). You will work side by side with other data scientists and traders to see where data science can add the most value. We aim to have a fast feedback loop of deploying, learning and adjusting, meaning that there is a strong focus on ownership and scalable automation of processes. Deploying your model makes real world impact – often the same day!

You will be working with large and growing datasets, so a continuous effort to improve forecasting, modelling, and decision support tooling is essential to stay ahead. Apart from developing these models you will also play a pivotal role to productionize those in a robust and reliable manner.

Is this about you?

• You have a quantitative MSc or equivalent experience in Computer Science, Mathematics, Statistics, Econometrics or a related quantitative field.

• You bring around 5 years of hands on experience in data science roles in a business context, with prior experience in (energy) trading being considered a plus.

• Proficient with optimization techniques such as linear programming.

• You have experience with building and deploying scalable trading and/or optimization algorithms in the cloud.

• Strong background in Python development: you know how to write modular and clean code, implement unit tests and proper monitoring.

• You understand underlying business problems, can distinguish between main and secondary issues and are able to translate these into robust data driven solutions.

• You have experience with SQL databases, Databricks and streaming data.

• Proactively initiating improvements and your drive to get things done is key.

• You do not hesitate to reach out to stakeholders from the business or IT side to make sure you build the best solution possible.

• You are familiar with - parts of - our tech stack: Azure Cloud, Kubernetes, Databricks, Airflow, Snowflake.

You’ll be responsible for

• Developing and maintaining advanced analytical models for cross-market optimization and bidding strategies. Using machine learning and (non)linear optimization methodologies.

• Driving automation and scalability, identifying where manual processes can be streamlined and operationalized.

• Identifying new ways to add value with data science in close collaboration with the traders to deliver integrated, high-impact solutions.

This is where you’ll work

You will work within the Flex Optimization team as part of the value chain Trading & Structuring, right next to Rotterdam-Alexander station. A complex, dynamic environment where moving markets, ever-changing positions, new technologies, and the law of inhibiting head start create a challenging field of tension which requires a lot of initiative and insight. We interact quickly with each other in an informal, transparent and collegial atmosphere. In a rapidly changing energy landscape, you and your team will shape the energy transition. A tough job, with challenging but achievable targets.

What we have to offer

Gross annual salary between €86.000 and €128.000

FlexBudget

Personal and professional growth

Hybrid working: home, office or abroad

Want more information about our terms of employment?

Work that works for you and the climate

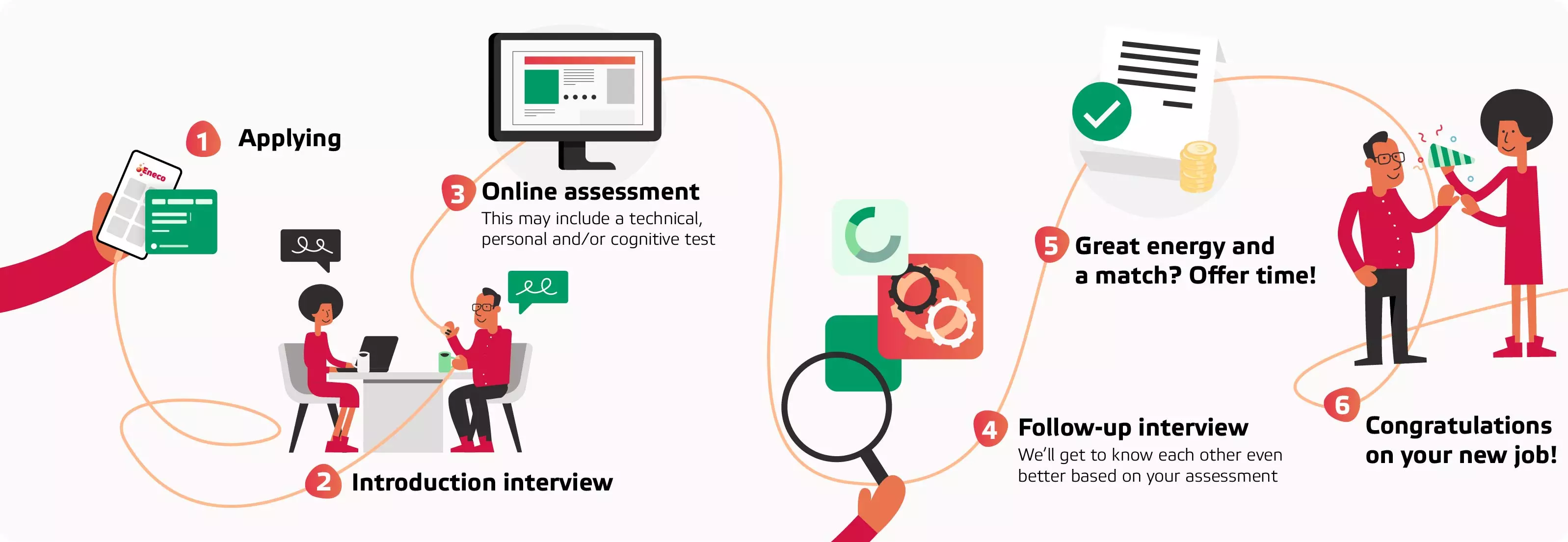

The phases of our application procedure:

Want to know more about this job function?

For more information about the application process, please contact Raymond Bosch, our Senior Recruiter for the Trade Community

[email protected]

Questions about the application procedure

Raymond Bosch

Send an email